Clinic Office Financing Solutions: 10 Best Ways to Fund Your Practice

Starting a medical practice is exciting, but clinic office financing solutions can make or break your success. From traditional bank loans to creative funding strategies, the right financial plan ensures long-term stability. Let’s dive into the best ways to fund your practice—whether you’re launching a new clinic or expanding an existing one.

Now, if you’ve already read my post on crafting a business plan and building a solid proforma, you’re ahead of the game! Hopefully, you’ve done your market analysis and know your short-term and long-term goals. If not—pause here, do the prep work, and return. You’ll need those documents to approach the funding sources we’re about to discuss.

Key Takeaways

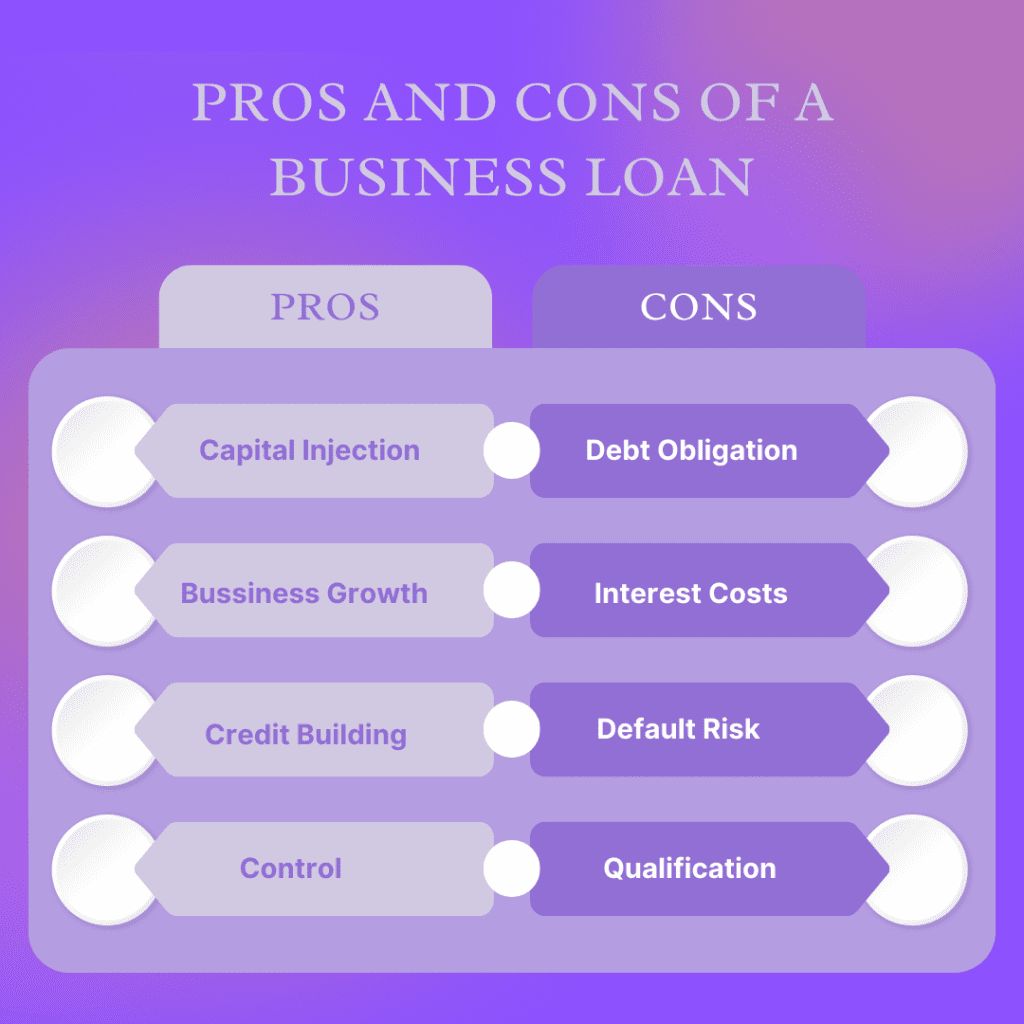

- Business Loans: Banks and credit unions offer structured financing but require a solid business plan.

- Second Mortgages: High-risk option; only proceed if confident in your business plan and financials.

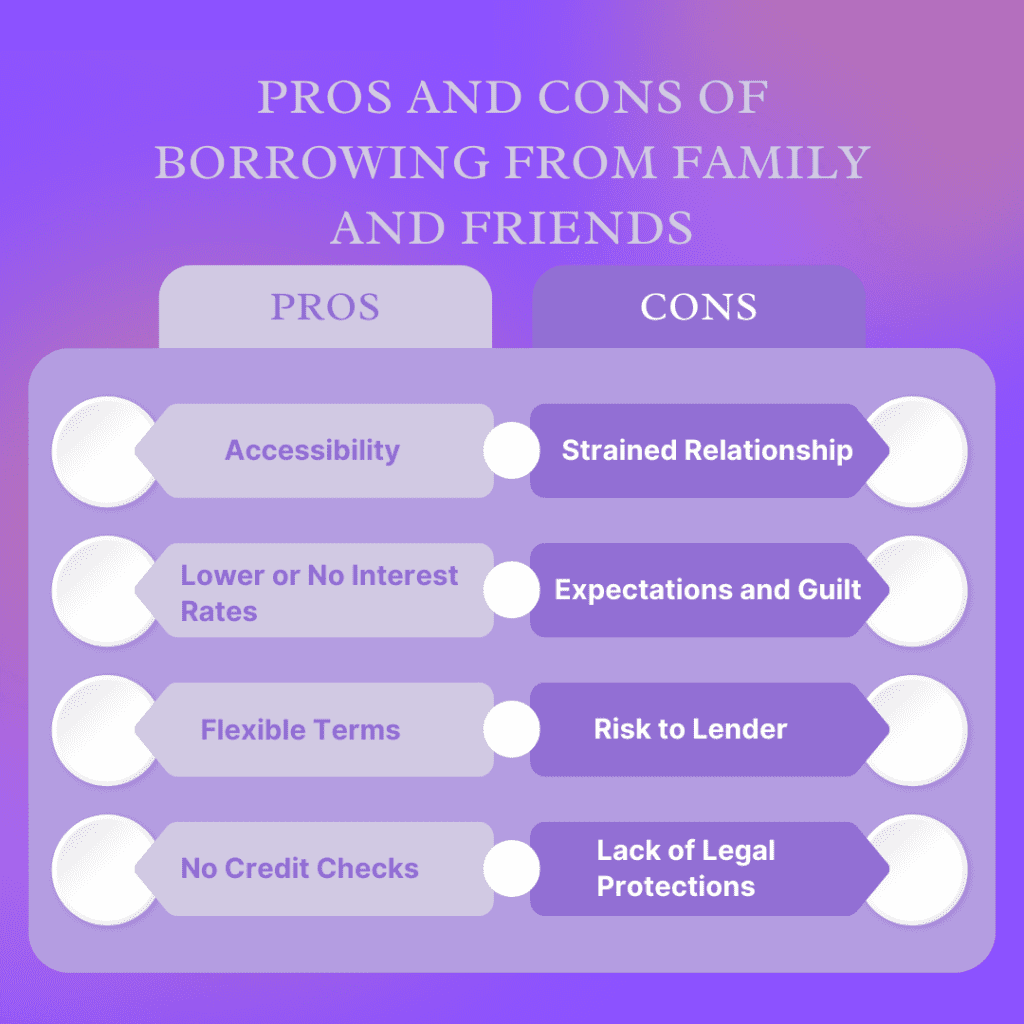

- Family & Friends: Formalize agreements to avoid strained relationships.

- Partnerships: Share costs and expertise, but always establish legal contracts.

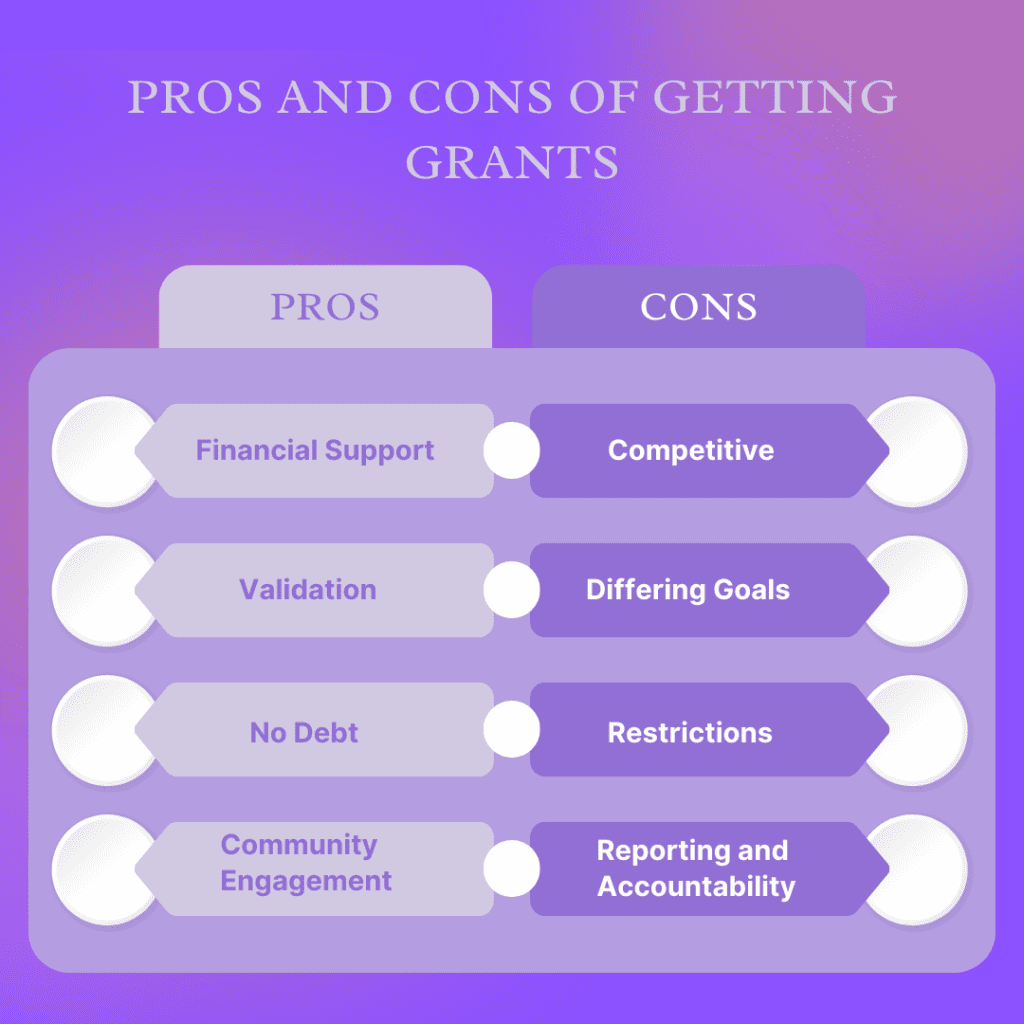

- Grants: Ideal for practices serving underserved populations; explore federal, state, and local options.

- Crowdfunding: A community-based approach to funding, great for promoting patient engagement.

- Franchising: Reduced financial risks by tapping into an established brand’s resources.

1. Business Loans Through Banks or Credit Unions

The traditional business loan is the most obvious route for medical practice funding options. Banks and credit unions are solid choices, but don’t overlook the latter—credit unions often offer lower interest rates, saving you a ton of money in the long run.

Here’s the trick: Be prepared. Banks want a well-thought-out business plan, including financial projections and how you intend to repay the loan. They’ll know and say no if your numbers don’t add up. So, bring your A-game here.

If you’re unsure where to start, check with local credit unions. Their focus on serving communities sometimes leads to better rates and more flexible terms than big banks.

2. Second Mortgages: High Risk, High Stakes

Using a second mortgage on your home is another common medical practice funding option, but proceed cautiously. This is high-risk territory. Statistically, many small businesses (including medical practices) don’t survive long-term. That’s not to scare you—it’s just the reality.

Before you go this route, ask yourself:

- Are you confident in your business plan?

- Can you handle losing your home if the practice doesn’t succeed?

If the answer is even a slight “no,” you may want to consider other options. Your peace of mind is worth more than the gamble.

Top 6 Reasons New Businesses Fail

3. Borrowing From Family and Friends

Ah, borrowing from loved ones—a tale as old as time. It’s tempting because it avoids the hoops of banks and other institutions but comes with risks. Money can complicate relationships faster than you can say “bad blood.”

If you choose this route, make it official. Hire a lawyer, draft a contract, and outline repayment terms. You don’t want Thanksgiving dinner to turn into a credit-collection nightmare. Keep it professional and transparent to avoid unnecessary drama.

4. Partnerships With Colleagues

Teaming up with another medical professional is a creative way to split the costs and reduce your financial burden. Partnerships can be a win-win for everyone involved. For example:

- Shared Costs: Each partner is only responsible for some upfront and ongoing expenses.

- Increased Expertise: Combining skills and specialties can make your practice more marketable.

However, there’s a caveat: legal contracts are non-negotiable. You need to define terms for:

- Responsibilities

- Revenue splits

- What happens if one partner wants to leave

- Licensing and ethical practices (to protect the business)

Without a detailed agreement, even the best partnerships can turn sour.

5. Grants: The Hidden Gems

Did you know there are grants designed specifically for medical practices? Many of these grants are available at the local, state, or federal level, especially if your practice will serve underserved populations.

However, many grants require you to operate as a 501(c)(3) nonprofit. If you’re interested in going this route, it’s worth doing deep research and consulting a legal or tax expert to see if you qualify.

Pro tip: Some counties and cities also have business development initiatives to support local healthcare providers. These programs often offer funding or resources for new practices.

6. Investors and Corporate Medicine Rules

If you’re looking at private investors, tread carefully. The “corporate practice of medicine” laws can complicate things. These laws vary by state and dictate who can own or invest in a medical practice.

For instance:

- In Oregon, the majority owner of a medical practice must be a licensed medical professional.

- In other states (say Florida, for example), you might not need a medical degree to be the majority owner.

Do your due diligence here. Partnering with investors can bring in significant funding, but it also means giving up some control over your business.

7. Lines of Credit: A Safety Net

Even if you don’t plan to fund your practice entirely with a line of credit, having one is always a good idea. Think of it as a financial cushion. If you experience delays in insurance reimbursements or face unexpected costs, a line of credit can help you keep the lights on and the payroll running.

Always shop around for the best interest rates; don’t rely on this as your sole funding source. It’s there for emergencies—not daily operations.

8. Credit Cards: The Wild Card Option

Believe it or not, credit cards can be a viable medical practice funding option if used strategically. Here’s when it might make sense:

- The interest rate on the card is lower than what you’d get from a loan.

- You can rack up rewards points like cashback or travel perks.

- You only need to cover smaller, one-time expenses (e.g., equipment purchases).

Still, don’t max out your cards unless you’re confident you can pay them off quickly. High-interest debt can spiral out of control fast.

9. Creative Cost-Saving Measures

While not directly funding options, these strategies can stretch your dollars:

- Equipment Financing: Explore financing or leasing equipment instead of buying everything outright.

- Used Equipment: Certified pre-owned medical equipment can save thousands without sacrificing quality.

- Delay Payments: Some vendors offer financing terms that allow you to delay payments until your practice is generating revenue.

Saving money where you can is just as important as raising it!

10. Healthcare-Specific Franchising

Yes, you heard that right—franchising isn’t just for fast-food chains! In healthcare, franchising has become a surprisingly viable option for opening a medical practice. This funding model allows you to tap into an established medical network’s resources, branding, and operational support while significantly reducing upfront costs.

Here’s how it works:

- You pay a franchise fee to join an established medical brand.

- The parent company provides you with operational blueprints, marketing assistance, and sometimes even partial funding or access to lenders.

- You benefit from their brand recognition, which can help you attract patients faster.

For example, franchises in urgent care or physical therapy clinics (like AFC Urgent Care or The Joint Chiropractic) often provide financing support through their network. While you lose some autonomy since you’re operating under their brand and must follow their guidelines, the reduced financial risk and support system can be a game-changer for first-time practice owners.

Why Consider Franchising?

- Lower Risk: Lenders are more likely to approve funding for a franchise because it’s tied to an already successful business model.

- Shared Resources: Equipment, software, and sometimes even staffing support can come through the parent company.

- Faster ROI: Established branding means patients already trust your services.

This route isn’t for everyone, especially if you dream of running a fully independent practice. But franchising could be the golden ticket for minimizing risk and funding headaches.

Crafting a Business Plan That Secures Funding

If you’re thinking of walking into a bank or meeting an investor with a vague idea of your practice, stop. It would help if you had a polished, professional business plan that answers every possible question they might have. Here’s what you need to focus on when presenting your plan:

Executive Summary: Tell a Story

This is the first impression you’ll make. Write this section like a story—concise, compelling, and confident.

- Briefly explain what kind of practice you’re opening and who you’re serving.

- Highlight the why: Why does your community need this practice? What’s the unique problem you’re solving? For example, is your medical practice filling a gap in underserved rural areas?

Make sure the tone here is optimistic but realistic. You want to convince lenders or investors that you’re worth betting on.

Financial Projections: The Numbers Don’t Lie

This is the backbone of your plan. Investors and banks care most about your ability to make money (and pay them back). Be crystal clear about:

- Start-Up Costs: Itemize every major cost, such as equipment, staff wages, lease, marketing, and technology.

- Revenue Streams: Will you make most of your money through insurance reimbursements, direct payments, or both?

- Break-Even Point: When do you predict your practice will start turning a profit? Use conservative estimates here—nobody likes an overly optimistic projection.

- Buffer Funds: Show that you’re planning for the unexpected. (Remember that advice about keeping 6–9 months of staff wages in reserve? This is where it comes in.)

Pro Tip: Use visuals. Lenders love clean graphs, tables, and charts that summarize your financials at a glance. Keep it professional but easy to digest.

Market Analysis: Show Them the Opportunity

Convince lenders or investors that your location and patient base are perfect. A great market analysis includes:

- Demographics: Who lives in the area? Age, income level, insurance coverage—what makes them a good fit for your practice?

- Competitors: Are there other practices nearby? How will you stand out? You can offer better patient care, flexible hours, or a niche specialty.

- Patient Demand: Provide data showing that the community has unmet medical needs. For example, “This area has only one pediatric clinic for a population of 10,000 children.”

Risk Mitigation Plan: Show You’re Prepared for the Worst

Let’s be honest—every lender knows there’s risk involved in starting a medical practice. Ease their concerns by outlining your risk mitigation strategies:

- What happens if your patient volume is lower than expected?

- How will you cover payroll during reimbursement delays?

- What backup plans do you have for staffing shortages or increased costs?

The more contingencies you address, the more confident lenders will feel about your ability to handle challenges.

Your Unique Selling Proposition (USP)

Think of this as your practice’s “X-factor.” What makes your medical practice different from every other clinic out there? Your USP could be:

- A focus on holistic care.

- Telemedicine options that make appointments more accessible.

- A specialty service that other clinics don’t offer (e.g., dermatology, mental health services, etc.).

Spell this out clearly. The stronger your USP, the more compelling your case for funding.

Creative Funding Ideas You Might Not Have Considered

Don’t give up if traditional loans or partnerships aren’t working for you. There are so many other ways to secure funding. Let’s explore a few more outside-the-box options:

SBA Loans for Medical Practices

The Small Business Administration (SBA) offers loan programs specifically designed for new businesses, including medical practices. SBA loans often have lower interest rates and longer repayment terms than traditional ones.

However, they require a lot of documentation, including:

- A detailed business plan (covered above).

- Financial projections.

- Your credit score (yes, you’ll need a good one).

SBA loans are attractive because they’re backed by the government, which makes lenders more willing to take the risk.

Crowdfunding: Let the Community Invest in You

Platforms like GoFundMe, Kickstarter, or Indiegogo aren’t just for artists and tech startups—they can also be great for medical practices. If you’re planning to serve a specific community, you can frame this as an opportunity for people to invest in healthcare access.

For example:

- Offer perks: “Donate $500 and get free wellness consultations for a year.”

- Tell your story: Explain why your practice is important and how it will impact the community.

While crowdfunding alone might not fully fund your practice, it can help supplement other funding sources.

Leasing vs. Buying Equipment

Sometimes, it’s not about raising more money—it’s about spending less. Medical equipment is one of the most significant costs for new practices, but you don’t necessarily have to buy everything upfront.

Consider leasing equipment instead. Leasing allows you to:

- Spread costs over time instead of paying a lump sum.

- Upgrade equipment more easily as technology advances.

- Keep your cash flow stable during the early days of your practice.

Government-Backed Healthcare Loans

Do you know some state and federal programs offer healthcare-specific loans? These programs are designed to increase access to healthcare in underserved areas. If your practice will serve rural or low-income populations, you may qualify for one of these programs.

Pre-Sale Patient Memberships

This is a bold but increasingly popular strategy. Essentially, you sell membership plans to future patients before your practice opens. Here’s how it works:

- Patients pay a flat monthly or annual fee in exchange for guaranteed access to services.

- You get upfront cash to help fund your practice.

This model works especially well for concierge medicine practices, where patients value personalized, premium care.

Presenting Yourself as a Safe Bet

Beyond your business plan, remember that lenders and investors are betting on you. Your professionalism, expertise, and enthusiasm can go a long way in convincing them to fund your practice. Here’s how to shine during your meetings:

- Dress the part: Show up looking like the future owner of a thriving medical practice.

- Be confident but not overconfident: Acknowledge the risks, but emphasize your readiness to manage them.

- Practice your pitch: You should be able to explain your practice and funding needs in 2–3 minutes without stumbling.

FAQ

What are the most common funding options for opening a medical practice?

The most common funding options include traditional bank or credit union loans, second mortgages, borrowing from family and friends, partnerships with colleagues, and grants. Each option has unique advantages and risks, so it’s essential to consider your financial situation and long-term goals before deciding.

How can I prepare for a business loan application for a medical practice?

To prepare for a business loan, create a well-documented business plan with financial projections and a repayment strategy. Include details like startup costs, revenue streams, and a break-even analysis. Strong preparation increases your chances of approval and favorable terms.

What are the risks of using a second mortgage to fund a medical practice?

A second mortgage is a high-risk option because you could lose your home if your practice fails. Before choosing this funding route, you must be confident in your business plan and have a strong backup plan. If you’re uncertain, consider other options.

Should I borrow money from family and friends to start my medical practice?

Borrowing from loved ones can simplify the process but risks straining relationships. If you go this route, create a formal agreement outlining repayment terms. Transparency and professionalism can help avoid conflicts and maintain healthy relationships.

What are the benefits of forming a partnership to fund a medical practice?

Partnerships allow you to share costs, combine expertise, and reduce financial burdens. However, you’ll need detailed legal contracts to outline roles, revenue splits, and exit strategies to ensure smooth operations and protect your business.

Are there grants available for funding a medical practice?

Yes, grants are often available for medical practices, especially those serving underserved populations. These may require nonprofit status or specific operational criteria—research local, state, and federal grant opportunities to determine your qualifications.

Can private investors help fund my medical practice?

Private investors can provide significant funding but may come with strings attached, such as reduced control of your practice. Be mindful of state-specific “corporate practice of medicine” laws, which may restrict investor involvement based on licensing requirements.

Is a line of credit a good option for medical practice funding?

A line of credit is a helpful safety net for unexpected expenses, such as insurance reimbursement delays or emergency repairs. However, due to higher interest rates, it’s not ideal as a primary funding source. Use it for temporary financial gaps.

Can credit cards be used to fund a medical practice?

Credit cards can be a viable option for smaller expenses, especially if the interest rate is low and you can pay off balances quickly. Be cautious, as high-interest debt can quickly become unmanageable if used irresponsibly.

Are there creative funding options for starting a medical practice?

Yes, crowdfunding, leasing equipment, pre-sale patient memberships, and franchising can help reduce startup costs. These alternatives may be less traditional but offer flexibility and community engagement opportunities.

Ready to Fund Your Practice?

By now, you’ve got a solid overview of medical practice funding options—from traditional loans to creative strategies like crowdfunding and pre-sale memberships. Remember, no matter which path you choose, the key is preparation. A strong business plan, clear financials, and a compelling story will take you far.