Self-Pay Fee Schedule: How to Build One for Uninsured Patients

Why a Self-Pay Fee Schedule Matters for Uninsured Patients

Setting up a self-pay fee schedule isn’t just about choosing numbers at random. You need to cover costs, stay legally compliant, and avoid conflicts with insurance companies. At the same time, underpricing can hurt profits, while overpricing might drive away cash-paying patients. Let’s break down how to set the right fees—without losing money or facing legal risks.

Table of Contents

Key Takeaways:

- A self-pay fee schedule ensures clear, upfront pricing for uninsured or cash-paying patients.

- Set self-pay rates at least 10-15% higher than your highest insurance reimbursement to avoid legal risks.

- Always collect payment upfront to reduce unpaid balances and administrative headaches.

- Offer structured discounts, not random deals, to avoid insurance contract violations.

- Train staff to discuss pricing confidently and maintain consistency in billing policies.

- Use automation for billing, payment plans, and reminders to streamline collections.

What Is a Self-Pay Fee Schedule?

A self-pay fee schedule is a pre-determined list of prices that healthcare providers charge uninsured or cash-paying patients for medical services. Unlike insurance-based pricing, where reimbursement rates vary by contract, a self-pay fee schedule ensures transparent, predictable costs for patients who are paying out of pocket.

Think of it as the “menu pricing” of healthcare. Just like a restaurant lists the cost of each dish, a self-pay fee schedule lays out the exact price per service, so patients know what to expect before their visit.

Why Do You Need a Self-Pay Fee Schedule?

If your practice treats uninsured patients or those who prefer to pay cash instead of using insurance, a self-pay fee schedule is essential.

Here’s why:

✅ Prevents Confusion – Patients know exactly how much they’ll be charged before treatment.

✅ Avoids Inconsistent Pricing – Ensures every self-pay patient is charged the same rate, avoiding legal risks.

✅ Protects Your Revenue – Helps your practice set fair prices that cover costs without losing money.

✅ Keeps You Compliant – Ensures self-pay rates align with insurance contracts to avoid audit risks.

Without a self-pay fee schedule, you risk undercharging, overcharging, or worse—violating insurance agreements by setting rates too low.

Self-Pay vs. Insurance Fee Schedules: What’s the Difference?

When it comes to medical billing, there’s a huge difference between a self-pay fee schedule and an insurance fee schedule. Understanding these differences is crucial for healthcare providers to ensure fair pricing, compliance, and financial stability.

Key Differences Between Self-Pay and Insurance Fee Schedules

| Factor | Self-Pay Fee Schedule | Insurance Fee Schedule |

|---|---|---|

| Who Pays? | Patient pays out of pocket | Insurance covers some or all costs |

| Pricing Control | Practice sets its own rates | Insurance negotiates rates with providers |

| Payment Timing | Payment collected at time of service | Payment delayed due to claims processing |

| Paperwork Required? | Minimal—patient pays directly | Requires claims submission, coding, & approvals |

| Discounts Allowed? | Practice can offer cash-pay incentives | Discounts depend on contract terms |

| Legal Risks? | Must comply with Medicare/Medicaid rules | Must follow insurance contracts & fraud prevention laws |

Summary: What Is a Self-Pay Fee Schedule?

A self-pay fee schedule is a clear, pre-determined list of medical service prices for uninsured or cash-paying patients. It ensures transparency, legal compliance, and financial sustainability for medical practices. Setting the right fee schedule protects your revenue, prevents legal pitfalls, and supports positive patient relationships.

Why Self-Pay Fees Must Be Higher Than Insurance Rates

One critical mistake some practices make is setting self-pay rates lower than their highest insurance reimbursement rate.

🚨 Why is this a problem?

If insurance companies see that you’re willing to accept lower payments from cash-paying patients, they might:

- Renegotiate contracts to pay you even less

- Flag your practice for audits

- Accuse you of insurance fraud for “dual pricing”

💡 Best Practice: Always set your self-pay rates at least 10-15% HIGHER than your highest-paying insurance reimbursement rate.

Which Fee Schedule Is Better for Your Practice?

It depends on your business model and patient base.

✅ Self-Pay Fee Schedules Work Best For:

- Practices that serve many uninsured or cash-pay patients

- Providers who want upfront payments with no claim delays

- Clinics that offer medical tourism or concierge medicine

✅ Insurance Fee Schedules Work Best For:

- High-volume practices that rely on insurance reimbursements

- Specialists with long-standing contracts with payers

- Clinics treating patients with employer-based insurance plans

💡 Hybrid Approach: Many practices use both self-pay and insurance fee schedules strategically—offering self-pay pricing for uninsured patients while maximizing insurance reimbursements for others.

Rules for Charging Self-Pay Patients: What You Need to Know

When setting up a self-pay fee schedule, you can’t just charge whatever you want. There are legal, ethical, and financial rules you need to follow to avoid compliance issues, patient disputes, and insurance contract violations.

Let’s break down the must-follow rules when charging self-pay patients.

Be Consistent: Same Rates for All Self-Pay Patients

One of the biggest legal risks when charging self-pay patients is inconsistency.

🚨 Rule: Every self-pay patient must be charged the same rate for the same service—no special discounts, no case-by-case deals.

Why?

❌ Inconsistent pricing could be seen as discrimination

❌ It creates legal risks under anti-kickback and Medicare laws

❌ It confuses staff and patients, leading to billing disputes

💡 Best Practice: Publish a fixed self-pay fee schedule and make sure every patient is charged the same amount for each CPT code.

Never Charge Self-Pay Patients Less Than Your Highest Insurance Rate

Some practices think they’re doing self-pay patients a favor by offering lower rates than what insurance pays. Big mistake.

🚨 Rule: Your self-pay rate should always be equal to or HIGHER than your highest insurance reimbursement.

Why?

❌ Insurance companies can lower their payments if they see you accepting less

❌ You could violate insurance contracts, leading to audits or clawbacks

❌ It looks like dual pricing, which can be considered insurance fraud

💡 Best Practice: Review your insurance contracts and set self-pay fees at least 10-15% above your highest payer’s allowed amount.

Offer Discounts the Right Way (Without Violating Laws)

Yes, you can offer cash discounts or payment incentives, but they must be done legally.

🚨 Rule: Any self-pay discount must be structured, documented, and applied consistently to avoid compliance issues.

How to Offer Discounts Safely:

✅ Same-Day Pay Discount – Example: 5-10% off if the patient pays in full at the time of service.

✅ Financial Hardship Discount – Require proof of income and have patients sign a hardship agreement.

✅ Membership Plans – Offer direct primary care (DPC) memberships where patients pay a monthly fee for services.

❌ Do NOT randomly adjust prices for certain patients without a clear policy in place—this can trigger insurance fraud concerns.

💡 Best Practice: Put discount policies in writing and ensure all staff follow them consistently.

Follow Medicare & Medicaid Rules for Self-Pay Patients

If your practice accepts Medicare or Medicaid, special rules apply when charging self-pay patients who are eligible for these programs.

🚨 Rule: You cannot charge a Medicare-eligible patient a self-pay rate unless they sign a Medicare opt-out agreement.

If a patient is eligible for Medicaid, you must bill Medicaid first unless you are a non-participating provider.

💡 Best Practice: If you treat Medicare or Medicaid patients, consult a healthcare attorney before setting self-pay policies.

Get Payment Upfront to Avoid Collections Issues

Unlike insurance patients, self-pay patients don’t have a third-party payer backing them—which means getting paid can be tricky if you’re not proactive.

🚨 Rule: Always collect full or partial payment upfront before providing services.

How to Enforce Upfront Payments:

✅ Require a deposit before the visit (e.g., 50% of the estimated cost)

✅ Offer payment plans—but only if an upfront percentage is paid

✅ Use digital payment links to collect before the appointment

💡 Best Practice: Train front desk staff to explain self-pay fees clearly and request payment before services are provided.

Clearly Communicate Costs to Patients

Many self-pay patients worry about hidden fees and unexpected medical bills. Avoid confusion by being transparent from the start.

🚨 Rule: Always inform self-pay patients of the full estimated cost before their appointment.

How to Improve Price Transparency:

✅ Create a self-pay fee schedule page on your website

✅ Give printed estimates at the time of booking

✅ Train staff to answer cost-related questions confidently

💡 Best Practice: When a patient books an appointment, confirm their self-pay status and provide a cost estimate upfront.

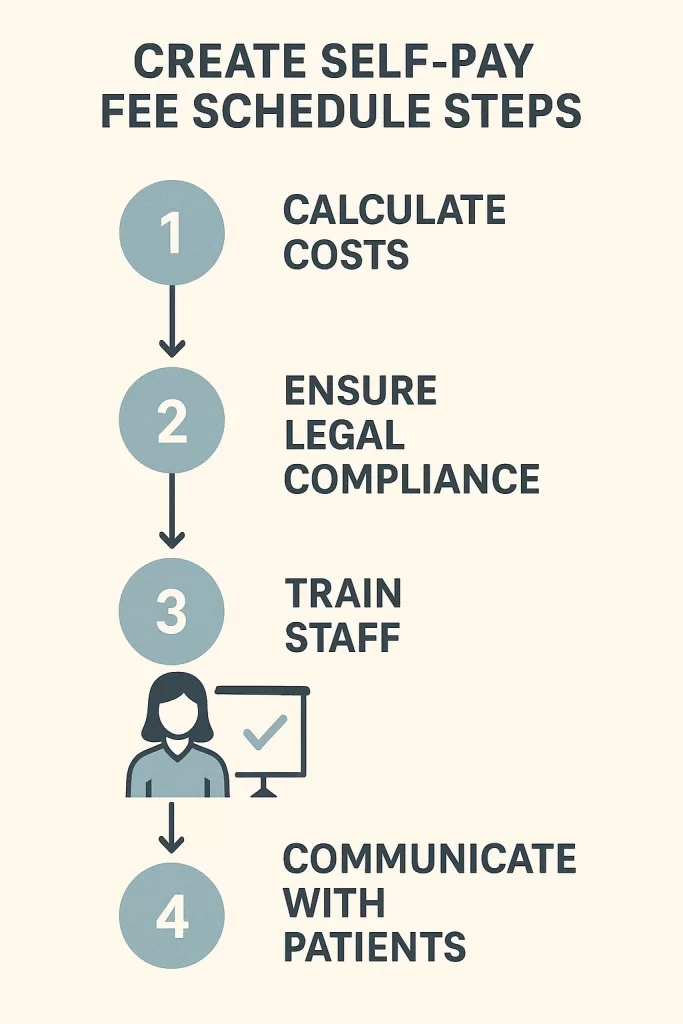

How to Create a Self-Pay Fee Schedule

Step 1: Calculate Your True Costs

Before setting any numbers, you need to figure out exactly how much it costs your practice to provide care. This isn’t just about the supplies you use for treatments—it includes everything:

- Staff wages (providers, nurses, admin, billing, etc.)

- Fixed overhead (rent, insurance, software subscriptions)

- Variable overhead (utilities like water, electricity, and waste disposal)

- Medical supplies for each service or procedure

Once you have a clear picture of your expenses, you can ensure your self-pay fee schedule isn’t selling you short. The goal is to cover the bare minimum cost while still allowing for profitability.

Step 2: Keep Your Policy Consistent

One of the biggest mistakes practices make? Making exceptions.

It might feel tempting to adjust fees for certain patients, especially if they have a compelling story. But if you start bending the rules, you could end up in serious trouble—especially with insurance companies.

The self-pay fee schedule should apply equally to every patient. No special deals, no case-by-case discounts. Every employee in your clinic—from the front desk to the doctors—needs to understand and enforce this rule.

Doctors, in particular, should not be discussing financials with patients. Patients feel comfortable with their doctors, which means they’re more likely to push for special exceptions. It’s best to set a strict policy that only the billing department, manager, or owner can discuss payments, costs, and financial options.

Step 3: Choose a Flat Fee or Sliding Scale

When designing your self-pay fee schedule, you have two main options:

Flat Fee Per CPT Code

This is the simplest and most straightforward approach. Each CPT code has a fixed price that applies to every self-pay patient, no exceptions.

Sliding Fee Schedule

If you want to offer more flexibility, a sliding fee schedule adjusts pricing based on the patient’s financial situation. However, this requires extra paperwork, as you’ll need to collect proof of income (pay stubs, tax returns, unemployment records, etc.).

Both approaches have pros and cons:

| Method | Pros | Cons |

|---|---|---|

| Flat Fee | Easy to implement, no extra admin work | Less flexibility for low-income patients |

| Sliding Scale | Helps lower-income patients afford care | Requires documentation & more admin work |

Choose the option that fits best with your workflow, staff capacity, and overall costs.

Step 4: Stay Legally Compliant

Now comes the not-so-fun part: legal compliance.

You need to check that your self-pay fee schedule doesn’t violate any Medicaid, Medicare, or commercial insurance contracts — especially as recent legal shifts like the FTC non-compete ban remind us how fast healthcare business regulations can change.. Some payers have rules about what you can charge uninsured patients, and if you’re not careful, you could end up violating your contracts.

For example, insurance companies might argue:

“If you’re willing to accept a lower rate from uninsured patients, then why should we keep paying you more?”

That’s why best practice is to set your self-pay rates HIGHER than your highest insurance allowed amount. This protects you from insurance payers trying to reduce your reimbursement rates.

A simple way to check? Run reports in your EHR or contact your insurance reps to get the allowed amounts for your most commonly billed CPT codes.

Step 5: Offer Discounts for Upfront Payments

One way to encourage faster payments is by offering a discount for patients who pay in full at the time of service.

For example, if your self-pay fee schedule sets a CPT code at $110 over Medicare’s rate, you could offer a 5-10% discount for patients who pay the full amount upfront.

This helps you:

- Avoid chasing payments later

- Reduce admin costs for billing & collections

- Improve cash flow for your practice

It’s a win-win for both you and the patient.

Step 6: Train Your Staff on Payment Conversations

Your front desk team plays a huge role in setting expectations with self-pay patients. When a patient schedules an appointment and mentions they are paying out of pocket, your team should be trained to explain:

- The estimated cost of their visit

- Payment options (pay-in-full discount vs. payment plan)

- How much they need to pay at the time of service

Having these conversations before the appointment prevents awkward surprises when it’s time to pay.

How to Set Your Self-Pay Fees Without Losing Money

One of the biggest challenges when setting a self-pay fee schedule is finding the right price point. If you charge too little, you’re losing money. If you charge too much, patients might skip care altogether.

Here’s how to get the balance right:

Use Your Highest Payer as a Benchmark

A solid rule of thumb is to set your self-pay rates slightly higher than your highest insurance payer’s allowed amount.

Why? Because if insurance companies see that you’re charging self-pay patients less, they might reduce their own reimbursements to match.

Let’s say Medicare reimburses $100 for a certain CPT code, but your highest commercial insurance pays $150. You should set your self-pay rate at $160-$175 to avoid insurance companies lowering their payments.

Consider Local Market Rates

Look at what other practices in your area are charging for self-pay patients. You don’t want to be significantly cheaper (because it could signal lower quality), but you also don’t want to be the most expensive option unless you provide exceptional value.

Account for Administrative Costs

Billing and collections take time and money. If you’re offering payment plans or sending statements, that’s additional labor costs. Make sure your self-pay fee schedule includes a buffer for these hidden expenses.

Should You Offer Payment Plans?

Many self-pay patients can’t afford to pay their full balance upfront, which is why some practices offer payment plans. But before you jump in, consider these key points:

Pros of Payment Plans

✅ Makes care more accessible for patients

✅ Increases the likelihood of collecting payment

✅ Reduces financial burden for patients, leading to better patient satisfaction

Cons of Payment Plans

❌ Increases administrative workload (tracking payments, sending reminders)

❌ Higher risk of patients defaulting on payments

❌ Delays cash flow, which can impact the practice’s finances

How to Set Up a Payment Plan the Right Way

If you decide to offer a payment plan, make sure you:

- Require an upfront deposit (e.g., at least 50% of the service cost at the time of the visit)

- Set clear terms (e.g., full balance must be paid within 3-6 months)

- Use automated payments (to reduce missed payments)

- Charge a small administrative fee to cover processing costs

Pro Tip: If a patient misses a payment, have a strict follow-up process in place. Don’t let overdue payments pile up!

Avoiding Legal Pitfalls With Your Self-Pay Fee Schedule

Insurance companies and government payers have strict rules about self-pay pricing, and violating them—even accidentally—can lead to penalties or audits.

Watch Out for “Dual Pricing” Issues

If an insurance company finds out that you’re charging self-pay patients significantly less than your contracted rate, they may:

- Demand lower reimbursements

- Accuse your practice of fraud

- Flag you for an audit

To avoid dual pricing issues, always ensure that your self-pay fees are at least equal to (or slightly above) your highest payer’s allowed amount.

Don’t Offer Discounts That Violate Contracts

Offering self-pay discounts can be a great way to encourage upfront payments, but they must be structured carefully.

If you’re contracted with Medicare, Medicaid, or commercial insurers, some contracts prohibit offering deeper discounts to cash-paying patients.

Before offering any discounts, review your contracts carefully or consult with a healthcare attorney to make sure you’re compliant.

Get Everything in Writing

If you’re using a sliding fee scale, payment plans, or offering discounts for upfront payments, make sure everything is documented.

- Have patients sign agreements acknowledging their payment responsibility

- Maintain clear records of payment plan terms and discounts applied

- Make sure your billing policies are written and accessible to all staff

How to Train Your Staff on Self-Pay Conversations

Your front office staff plays a crucial role in communicating self-pay policies effectively. They need to be trained on how to confidently discuss pricing, payment options, and financial policies without hesitation.

Best Practices for Staff Training

1️⃣ Use Role-Playing Exercises – Practice common patient scenarios where patients ask for discounts, payment plans, or financial help.

2️⃣ Provide a Simple Self-Pay Fee Schedule Cheat Sheet – Staff should have a quick-reference guide so they can easily explain pricing to patients.

3️⃣ Teach Them How to Be Firm but Compassionate – Patients may try to negotiate or appeal to emotions. Staff should stay consistent while remaining empathetic.

4️⃣ Make Sure Everyone Knows Who Can Discuss Finances – Doctors should NOT be discussing financials with patients. All financial conversations should be handled by the billing department, office manager, or owner.

Self-Pay Fee Schedule Mistakes to Avoid

Even with the best intentions, many practices make mistakes when setting up their self-pay fee schedule. Here are some of the biggest pitfalls to watch out for:

🚨 Mistake #1: Charging Less Than Your Lowest Insurance Payer

✅ Fix: Always set self-pay rates higher than your highest allowed amount.

🚨 Mistake #2: Giving Discounts Without Checking Legal Guidelines

✅ Fix: Review your Medicare, Medicaid, and commercial insurance contracts before offering discounts.

🚨 Mistake #3: Not Training Your Staff on Financial Conversations

✅ Fix: Conduct regular staff training so they handle pricing discussions confidently and consistently.

🚨 Mistake #4: Not Having a Clear, Written Policy

✅ Fix: Document everything—payment plans, self-pay rates, discount policies—so there’s no confusion.

How to Market Your Self-Pay Fee Schedule to Patients

Having a self-pay fee schedule is great—but if uninsured or cash-paying patients don’t know about it, it won’t help your practice or them.

Create a Dedicated “Self-Pay Pricing” Page on Your Website

Make it easy for patients to find your self-pay rates by having a clear, easy-to-read pricing page on your website.

What to Include on the Page:

✅ Transparent pricing for common services (avoid vague language)

✅ Discounts for upfront payments (if applicable)

✅ Payment plan options (if offered)

✅ Frequently asked questions about self-pay policies

Example:

💡 “Uninsured? No problem! We offer a simple, transparent self-pay fee schedule so you know exactly what to expect.”

Having clear pricing online builds trust, prevents confusion, and reduces front desk calls about costs.

Use Social Media & Email to Educate Patients

Many people assume medical care is unaffordable without insurance, so they don’t even bother calling.

Use social media and email newsletters to inform potential patients that your self-pay pricing is affordable, transparent, and flexible.

📢 Example Facebook Post:

“Did you know we offer affordable self-pay options for uninsured patients? Our transparent pricing ensures no surprises. Book your appointment today!”

💌 Example Email to Patients:

Subject: Worried About Medical Costs? We’ve Got You Covered!

“If you don’t have insurance, we offer affordable, upfront self-pay pricing so you never have to guess what your visit will cost. Visit our website to learn more.”

This type of consistent messaging helps uninsured patients feel comfortable reaching out.

Train Your Front Desk to Discuss Self-Pay Options Proactively

Many self-pay patients avoid medical care because they assume it’s too expensive. Your front desk team can change that by addressing cost concerns upfront.

💬 How to Train Staff to Talk About Pricing:

Instead of saying:

“We don’t take insurance. You’ll have to pay out of pocket.”

✅ Say this instead:

“We offer a clear, affordable self-pay fee schedule for uninsured patients, and we have payment options to make it easier for you.”

Instead of saying:

“It depends on what the doctor does.”

✅ Say this instead:

“For most visits, the self-pay price is [amount], and we always discuss costs with you before moving forward.”

This approach reduces patient anxiety and increases collections.

How to Handle Self-Pay Patients Who Can’t Pay

Even with a clear self-pay fee schedule, you’ll encounter patients who say they can’t afford to pay.

Here’s how to handle it without losing revenue:

Offer a “Same-Day Pay” Discount

Instead of negotiating on the spot, have a pre-set policy that offers a small discount (e.g., 5-10%) for patients who pay in full at the time of service.

Example:

Regular Self-Pay Price: $150

Same-Day Pay Discount: $135 (10% off)

This encourages immediate payment, reduces billing costs, and increases overall collections.

Require a Deposit for Payment Plans

If a patient can’t pay in full, a payment plan may be an option—but NEVER let them leave without paying something upfront.

📢 Example Policy:

“We offer a payment plan if you pay at least 50% today. The remaining balance must be paid within 3 months.”

Key Takeaways:

✅ Always require some payment upfront

✅ Keep payment plans short (3-6 months max)

✅ Automate payments when possible

Use a Financial Hardship Policy (Only If Absolutely Necessary)

If your practice wants to help truly low-income patients, consider a financial hardship policy where patients can apply for reduced fees.

But be careful—if you offer too many discounts, insurance companies may question why you’re billing them more than self-pay patients.

How to Structure a Hardship Program:

✅ Require proof of income (tax returns, pay stubs)

✅ Offer a fixed discount (e.g., 15-20%)—don’t negotiate case-by-case

✅ Keep the process formal (written policy + signed agreements)

This ensures fairness while preventing abuse.

How to Reduce Self-Pay Collections Issues

Unpaid balances from self-pay patients can drain your revenue. Here’s how to minimize non-payments:

Collect Payment at the Time of Service

📢 Practice policy: “All self-pay patients must pay at least 50% of their balance before services are rendered.”

Why? Because once the patient leaves, your chances of collecting drop significantly.

Send Digital Invoices Immediately

Patients forget to pay. Reduce the chance of unpaid balances by sending digital invoices (via email or text) right after the visit.

✅ Use automated payment reminders

✅ Offer easy online payment options

The easier you make it, the faster you’ll get paid.

Charge a Late Fee for Overdue Balances

If a patient misses a payment, charge a late fee ($10-$25) to encourage on-time payments.

Example:

“Balances not paid within 30 days will incur a $15 late fee.”

This creates urgency and prevents patients from ignoring their bills.

How to Automate Your Self-Pay Fee Schedule for Maximum Efficiency

A well-structured self-pay fee schedule shouldn’t require constant manual work. By automating key processes, you can reduce administrative burden, improve collections, and minimize human error.

Implement Online Payment Portals

If you’re still relying on paper invoices and phone calls to collect payments, you’re making things way harder than they need to be.

Set up a secure online payment portal where self-pay patients can:

✅ View their outstanding balance

✅ Make payments instantly

✅ Set up automatic payment plans

💡 Pro Tip: Use platforms like Square, Stripe, or PayPal to make transactions seamless.

Use Automated Billing & Payment Reminders

Patients forget bills—but automated reminders ensure they don’t.

🔔 Example Automated Reminder Sequence:

📅 Day of Visit – Send a payment link via email/SMS

📅 7 Days Later – Friendly reminder: “Your balance is due soon!”

📅 30 Days Later – “Your payment is overdue—please pay now to avoid late fees.”

📅 60 Days Later – Final warning before collections

💡 Pro Tip: Use EHR systems with built-in billing automation (e.g., Athenahealth, Kareo, or AdvancedMD).

Use Digital Intake Forms to Collect Payment Info Upfront

Before a patient even steps into your clinic, make sure you’ve already collected their payment preferences.

🚀 How to Do It:

✅ Add a self-pay policy agreement to your digital intake forms

✅ Require patients to input credit card info upfront for security

✅ Offer an option to prepay for services at the time of booking

This eliminates awkward financial discussions at checkout and ensures faster collections.

Self-Pay Fee Schedule: Real-World Case Studies & Lessons Learned

Case Study 1: How a Small Clinic Increased Self-Pay Collections by 40%

A private primary care practice was struggling to collect payments from self-pay patients. The main issues?

❌ No clear self-pay fee schedule

❌ Inconsistent staff communication about pricing

❌ Patients leaving without paying

What They Did:

✅ Created a transparent self-pay pricing page on their website

✅ Trained front desk staff to discuss costs upfront

✅ Implemented a 5% discount for same-day payments

The Result?

💰 40% increase in same-day collections and fewer unpaid balances!

Case Study 2: Avoiding an Insurance Audit Due to Low Self-Pay Rates

A mid-sized urgent care was offering deep discounts for cash-paying patients, charging them significantly less than their insurance reimbursements.

The problem? A commercial insurance provider noticed the low self-pay rates and threatened to renegotiate their contract at lower reimbursement rates.

What They Did:

✅ Adjusted their self-pay rates to be at least 10% higher than their highest payer

✅ Reviewed insurance contracts to ensure compliance

✅ Implemented better record-keeping practices for self-pay discounts

The Lesson?

🚨 Never charge self-pay patients LESS than your highest insurance reimbursement rate!

Frequently Asked Questions About Self-Pay Fee Schedules

Setting up a self-pay fee schedule can be confusing, especially with all the legal, financial, and operational considerations. Below are the most common questions providers have about self-pay pricing, compliance, and best practices.

What is a self-pay fee schedule?

A self-pay fee schedule is a pre-determined list of prices for medical services that healthcare providers charge to uninsured or cash-paying patients. Unlike insurance reimbursements, which vary by payer contracts, a self-pay fee schedule ensures clear, upfront pricing for out-of-pocket patients.

Why do self-pay rates need to be higher than insurance reimbursements?

If your self-pay rates are lower than your highest insurance reimbursement, insurers may demand lower payments, accuse your practice of dual pricing, or even audit your billing practices. To avoid compliance issues, always set self-pay rates 10-15% above your highest insurance payer’s allowed amount.

Can I offer discounts to self-pay patients?

Yes, but they must be structured and documented to avoid legal issues. You can offer:

✅ Same-day pay discounts (e.g., 5-10% off if paid in full at the time of service)

✅ Financial hardship discounts, but only with proof of income

✅ Membership plans, where patients prepay for services monthly

Do not randomly adjust pricing on a case-by-case basis—it could be considered insurance fraud.

Do Medicare and Medicaid patients qualify for self-pay pricing?

If you accept Medicare or Medicaid, you must bill them first unless the patient has signed a Medicare opt-out agreement (for providers who have formally opted out of Medicare). Medicaid rules vary by state, but in most cases, you cannot bill a Medicaid-eligible patient directly.

Always check state and federal regulations before charging Medicare/Medicaid self-pay rates.

Should I collect payment upfront from self-pay patients?

Yes! Collecting payment upfront is the best way to avoid unpaid balances and reduce billing headaches.

✅ Require deposits before visits (e.g., 50% of the estimated cost)

✅ Offer payment plans, but only if patients pay a portion upfront

✅ Use online payment links for easy prepayment

Patients who leave without paying are less likely to settle their bills later.

How can I market my self-pay fee schedule to patients?

✅ Create a pricing page on your website so patients know what to expect

✅ Train front desk staff to explain self-pay options with confidence

✅ Use social media and email marketing to highlight affordable pricing

✅ Offer incentives, like discounts for same-day payments

Transparency in pricing builds trust and helps convert more self-pay patients.

Can I charge different self-pay prices based on patient income?

Yes, but only if you have a structured sliding fee schedule based on income verification.

If you choose to offer income-based pricing, make sure to:

✅ Require proof of income (e.g., tax returns, pay stubs)

✅ Have patients sign a financial hardship form

✅ Apply the same discount structure consistently

This prevents discriminatory pricing and ensures compliance with federal and insurance regulations.

What happens if a self-pay patient can’t pay their bill?

If a patient can’t afford their bill, you can:

✅ Offer a same-day discount to encourage immediate payment

✅ Set up a short-term payment plan (3-6 months max, with an upfront deposit)

✅ Charge a late fee for overdue payments to prevent ignored bills

Avoid letting unpaid balances stack up—it costs time and money to collect later.

Can I refuse service to a self-pay patient who won’t pay upfront?

Yes, except in emergency situations. If a patient refuses to pay upfront and does not qualify for hardship assistance, you can:

✅ Offer a payment plan with an initial deposit

✅ Direct them to community clinics with financial assistance options

✅ Refuse non-urgent services if they do not agree to your payment policy

Always follow legal guidelines and document any patient payment discussions.

How often should I update my self-pay fee schedule?

Review your self-pay fee schedule at least once a year to:

✅ Adjust for inflation and rising costs

✅ Ensure your fees are still higher than your highest insurance reimbursement

✅ Stay competitive with local market rates

If insurance reimbursements change mid-year, adjust your self-pay rates accordingly.

What is the biggest mistake practices make with self-pay pricing?

🚨 Biggest Mistake: Charging less than your highest insurance reimbursement rate.

Other common mistakes include:

❌ Inconsistent pricing (charging different patients different rates)

❌ Not collecting upfront payments (leading to unpaid balances)

❌ Offering undocumented discounts (which can trigger audits)

❌ Ignoring insurance contract terms (which can lead to reimbursement reductions)

A well-structured self-pay fee schedule protects your practice legally and financially – A well-structured self-pay fee schedule protects your practice legally and financially — and works best when combined with strong revenue cycle management processes to maximize collections and cash flow.

Best Practices for Self-Pay Fee Schedules

Setting up a self-pay fee schedule isn’t just about picking numbers—it’s about strategy, compliance, and financial stability. By now, you’ve learned how to calculate the right pricing, stay legally compliant, train your staff, and optimize collections to ensure your practice remains profitable while serving self-pay patients effectively.

Here’s what you’ve gained from this guide:

✅ A clear understanding of how self-pay fee schedules work and why they matter

✅ The right pricing strategy to avoid legal pitfalls and maximize revenue

✅ Best practices for offering discounts, payment plans, and upfront collections

✅ The ability to train your staff to confidently discuss self-pay pricing

✅ A blueprint for automating billing and reducing unpaid balances

By applying these strategies, you’re not just setting prices—you’re building a financial system that keeps your practice secure, compliant, and thriving.

💡 Ready to take action? Implement these changes today, and watch your self-pay revenue grow while reducing headaches from unpaid bills!