Medical Practice Financial Reports: What to Track Daily, Monthly & Yearly

Running a medical office without financial reports is like flying blind. Medical practice financial reports help you track revenue, spot billing issues, and make smarter decisions for long-term growth. From daily deposits to year-end performance reviews, here’s exactly what to track—and why it matters.

Key Takeaways:

- Daily reports ensure timely payment reconciliation and accurate cash flow.

- Weekly reviews help you monitor revenue, provider productivity, and deposit consistency.

- Monthly reports offer insights into denial trends, aging balances, and CPT code performance.

- Quarterly comparisons highlight broader revenue and workflow trends.

- Year-end reports guide budget planning, growth strategies, and payer negotiations.

- New practices benefit greatly from early reporting to identify payer and service performance.

- Key metrics like A/R days, net collections, and denial rates drive smarter decisions.

Why Financial Reports for Your Medical Practice Are Crucial

Whether you’re running a small practice or managing a larger one, financial reports for your medical practice are the backbone of understanding your revenue streams and identifying inefficiencies. From reconciling payments to spotting insurance trends, these reports help you stay on top of your finances while optimizing your workflows.

Below, we’ll dive into which financial reports you should be running daily, weekly, monthly, quarterly, and yearly to keep your practice thriving.

Daily Reports: Keep the Pulse on Your Practice

Patient Payments

A key daily report is one that tracks patient payments. This ensures you’re reconciling all funds collected from patient co-pays, coinsurance, deductibles, or outstanding balances.

- Why it matters: It helps you ensure your front desk is collecting and posting payments correctly, and that these match what’s showing up in your merchant services account (credit card system).

- Best practices: Patient payments should be reconciled at the end of the day by your front desk team. The next morning, your manager (or you) should double-check everything. The sooner you catch a discrepancy, the easier it is to resolve.

Insurance Payments

Insurance payments should be reconciled separately. Many insurance companies pay via EFTs (electronic fund transfers) or ACH transfers, and it’s critical to ensure two things:

- The payment was applied to the correct claims in your billing system.

- The payment was actually deposited in your bank account.

- Pro Tip: If your volume isn’t high, you can run this report weekly, but daily checks are always better for catching issues quickly.

Weekly Reports: Big-Picture Checks

Every week, you want to get a sense of how your practice performed financially. Weekly reports should include:

Total Revenue Collected

This shows the total amount your practice brought in over the week, broken down by patient payments and insurance payments.

- Why this is key: It gives you a snapshot of your practice’s financial flow, helping you identify shortfalls before they become problems.

Provider Performance

If your practice has multiple providers, this report helps you see how many patients were seen and how much revenue each provider generated.

- Pro Tip: Comparing provider performance can help you identify inefficiencies or potential opportunities (like expanding hours or adding another provider).

Cash and Check Deposits

Depositing cash and checks at least once a week is critical. However, if your volume is high, consider daily deposits.

- Why it matters: Patients expect their checks to clear promptly, and holding onto them for too long isn’t great for customer service. Plus, frequent deposits reduce the risk of checks being misplaced or forgotten.

Monthly Reports: A Deep Dive Into Your Practice’s Financial Health

At the end of every month, financial reports for your medical practice should give you a comprehensive view of your billing, collections, and workflow efficiency.

Aging Reports

An aging report breaks down outstanding claims by time buckets (e.g., 0–30 days, 31–60 days, etc.).

- What to look for: The majority of your balances should fall into the 0–30 and 31–60 buckets. If the older buckets are growing, it’s a red flag.

- Pro Tip: If you outsource billing, make sure your billing company is actively working on the older accounts. If you manage billing in-house, assign a team member to follow up on aged claims.

Insurance Trends

Your software should provide a month-end report detailing:

- Top payers (e.g., which insurance companies paid the most).

- Reimbursements by CPT code (e.g., what you’re billing vs. what you’re actually getting paid).

- Denial trends (e.g., are specific CPT codes being denied more often?).

- Why this matters: This helps you spot reimbursement issues, coding errors, or workflow gaps that are costing you money.

Quarterly Reports: Bigger Picture Insights

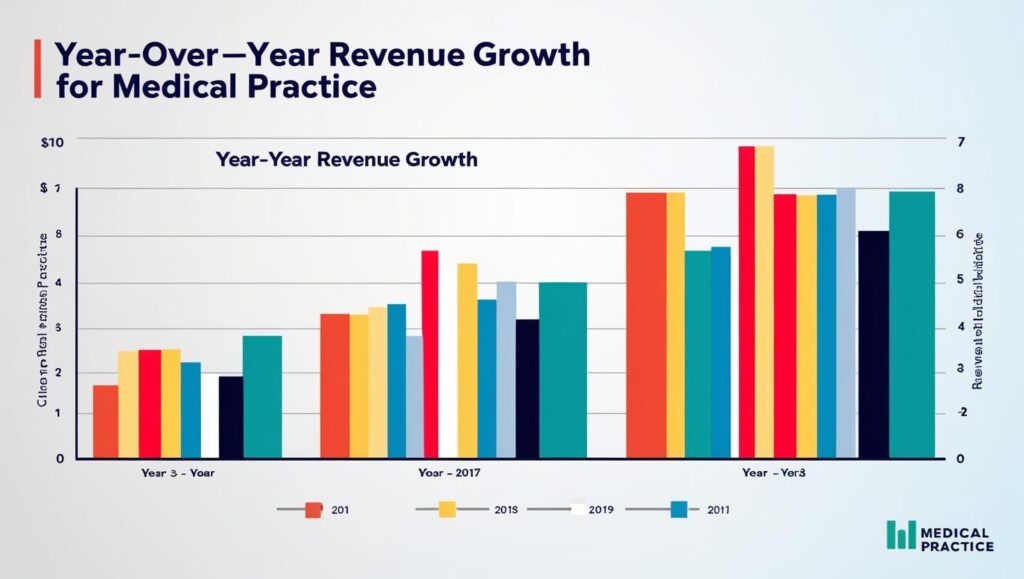

While monthly reports are great for short-term analysis, quarterly reports provide a broader perspective.

Quarter-over-Quarter Comparisons

- Revenue trends: How does this quarter’s revenue compare to the last?

- Provider productivity: Are providers maintaining or improving their patient volumes?

- Insurance performance: Have reimbursements shifted for any major payers?

Quarterly reviews give you enough data to identify larger trends without waiting until year-end.

Year-End Reports: The Ultimate Financial Health Check

Finally, your year-end report is where you dig deep into the overall performance of your practice. It’s also a critical tool for budgeting and planning for the next year.

What to Include in Your Year-End Report

- Beginning and ending AR (accounts receivable).

- Provider productivity for the year.

- Revenue by payer (top insurance companies, patient payments, etc.).

- Your most billed and reimbursed CPT codes.

- Why it’s important: This data helps you renegotiate contracts, set budgets, and identify areas for growth in the coming year.

Pro Tip for New Practices

If you’re in the first year of running your medical practice, financial reports are even more critical. They help you:

- Track your cash flow.

- Identify which payers are reimbursing well (and which aren’t).

- Understand the true cost of running your practice.

Monthly Financial Reports for Your Medical Practice

Monthly financial reports are the real superheroes of your medical practice’s financial health. They not only show you how much money came in (or didn’t) but also give you actionable insights into workflow efficiency, billing performance, and staff productivity. Let’s break it all down.

The Anatomy of Month-End Financial Reports

Every financial report for your medical practice that you run monthly should provide a detailed overview of your revenue, trends, and performance. These reports can help you course-correct in real-time, rather than waiting until it’s too late to fix issues.

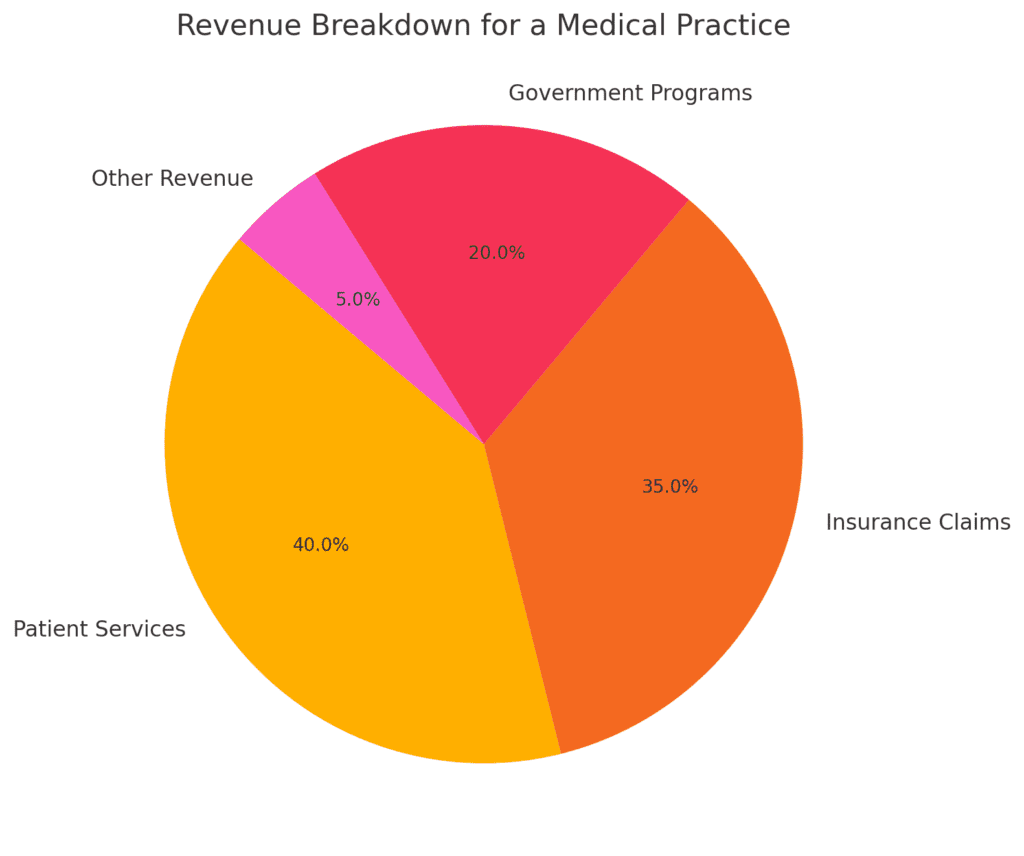

Monthly Revenue Breakdown

Your first stop is looking at your total revenue for the month. This should include:

- Total patient payments received.

- Total insurance payments received.

- A breakdown of revenue by payer (e.g., which insurance companies and patients contributed the most).

Why it matters: This gives you a bird’s-eye view of how much money your practice is actually bringing in versus how much you’re billing. If payments are down but charges are steady, it might mean issues with claim denials, patient payment collections, or payer reimbursement policies.

Aging Reports: The Good, The Bad, and the Ugly

Aging reports track outstanding balances based on how long they’ve been unpaid. They typically include:

- 0–30 days: Fresh claims you just sent out.

- 31–60 days: Claims that haven’t been paid but should be on their way.

- 61–90 days: Slightly concerning claims that require follow-up.

- 91–120 days: These claims are getting stale.

- 120+ days: Uh-oh. These claims are ancient and require immediate action.

Why it matters: The older a claim is, the harder it becomes to collect. Ideally, your 0–30 and 31–60 buckets should hold the majority of your outstanding balances. If balances in the 91–120 or 120+ days buckets are creeping up, it’s time to investigate:

- Is your billing team (or company) following up?

- Are claims being rejected due to coding errors or missing documentation?

- Are certain payers delaying payments unnecessarily?

Pro Tip: Compare aging reports month-over-month to spot trends. If older balances are growing, dig deeper to identify what’s causing the backlog.

Denial Trends and Insurance Performance

Your monthly financial reports should highlight which claims are being denied, why, and by whom.

- Top denial reasons: Are payers rejecting claims for coding errors, missing documentation, or eligibility issues?

- Insurance reimbursements: Are certain payers reimbursing less for the same CPT codes compared to others?

Why it matters: By understanding payer trends, you can address inefficiencies in your billing workflows and even renegotiate contracts with underperforming insurance companies.

Example: If Insurance Company X consistently denies claims for the same CPT code, it’s time to investigate whether you need to update your coding practices or appeal denials more aggressively.

CPT Code Analysis: What’s Earning You the Most Money?

Every medical practice has certain CPT codes that make up the bulk of its revenue. A monthly report should show:

- Your most billed CPT codes.

- Your highest reimbursed CPT codes.

- The average reimbursement per CPT code, broken down by payer.

Why it matters: If certain codes are underperforming (low reimbursements, frequent denials), this data helps you make changes. For instance:

- If a high-volume code is being underpaid by a specific payer, you may need to renegotiate that contract.

- If certain codes are frequently denied, it could mean coding or documentation errors.

Front Desk Collections Performance

Your front desk staff plays a huge role in ensuring your practice gets paid. A financial report for your medical practice should include data on:

- How much your staff collected in co-pays, coinsurance, and deductibles at the time of service.

- Whether patient payments were posted correctly to the billing system.

Pro Tip: Run a patient balance report for the upcoming day’s schedule and provide it to your front desk team. This gives them a heads-up about which patients owe money, so they can collect payments during check-in.

Key Metrics to Track Monthly

To make your month-end financial reports actionable, focus on these key metrics:

| Metric | Why It’s Important |

|---|---|

| Total Charges | Shows how much you’re billing out to patients and insurance companies. |

| Total Payments | Tracks how much revenue you’re actually collecting. |

| Net Collection Rate | Measures how much you’ve collected versus what you’re allowed to collect. |

| Denial Rate | High denial rates indicate potential problems with coding, documentation, or workflows. |

| A/R Days Outstanding | The average number of days it takes to collect payments. The lower, the better. |

How to Use Monthly Reports for Better Decision-Making

The power of financial reports for your medical practice lies in how you use the data. Here are a few actionable steps:

- Improve Patient Collections: If your front desk staff is missing payments, consider implementing training or new SOPs.

- Address Coding Issues: High denial rates for specific CPT codes? Time for a coding audit.

- Reevaluate Insurance Contracts: Are certain payers reimbursing far less than others? Use your data to negotiate better rates.

- Plan for Growth: If your revenue is steadily increasing, consider adding providers, extending hours, or investing in new equipment.

Quarterly and Year-End Reports: Planning for the Future

Quarterly Reports

While monthly reports focus on short-term performance, quarterly reports give you a broader view. Use them to compare performance across three-month periods.

- Revenue Trends: Are you growing, staying flat, or declining?

- Aging Trends: Are outstanding balances shrinking, or are older claims piling up?

- Provider Comparisons: Are all providers contributing equally, or are there significant disparities?

Pro Tip: Use quarterly data to set actionable goals. For example, if denial rates spiked in the last quarter, make reducing them a top priority for the next one.

Year-End Reports

Year-end reports are all about the big picture. They provide insights into your practice’s overall performance and help you prepare for the future.

Here’s what to include:

Revenue Analysis

- Total charges vs. total payments for the year.

- Revenue by payer and by provider.

- Top CPT codes for the year.

Budgeting and Planning

- Use revenue data to set budgets for payroll, supplies, and other overhead costs.

- Identify opportunities for renegotiating payer contracts or adjusting service offerings.

Financial Health Metrics

- Beginning vs. ending A/R.

- Trends in aging buckets over the year.

- Average reimbursement rates by payer.

Workflow Efficiency

- Identify problem areas in your billing or collections processes.

- Determine whether additional staff training or new software is needed to improve efficiency.

FAQs About Financial Reports for Your Medical Practice

When it comes to managing financial reports for your medical practice, there are plenty of questions that arise—whether you’re just starting out or trying to streamline your operations. Below, we’ve compiled the most common questions (and answers) to help you stay on top of your financial reporting game.

What are the most important financial reports for a medical practice?

The key financial reports for your medical practice include:

- Daily Reports: Patient payments, insurance payments, and deposit reconciliation.

- Weekly Reports: Total revenue collected, cash/check deposits, and provider performance.

- Monthly Reports: Aging reports, denial trends, CPT code analysis, and front desk collections.

- Quarterly Reports: Trends in revenue and aging over three-month periods.

- Year-End Reports: Comprehensive financial health metrics, provider productivity, and payer performance.

These reports ensure you’re monitoring cash flow, minimizing payment delays, and identifying areas for improvement.

How often should I run financial reports for my practice?

- Daily: Reconcile patient and insurance payments.

- Weekly: Review revenue, deposits, and overall performance.

- Monthly: Analyze aging reports, denial trends, and CPT code performance.

- Quarterly: Compare trends in collections, revenue, and payer performance.

- Yearly: Assess your practice’s overall financial health and set goals for the upcoming year.

Consistency is key—frequent reporting ensures small issues don’t turn into big problems.

Why is reconciling insurance payments so important?

Insurance payments often come via EFTs (electronic fund transfers) or ACH transfers. Reconciling ensures that:

- Payments were posted correctly to the right claims in your billing system.

- Funds were actually deposited into your bank account as promised by the insurance companies.

Without this, you risk under-reporting revenue or missing unpaid claims altogether.

What is an aging report, and why does it matter?

An aging report tracks outstanding claims or balances based on how long they’ve been unpaid. It’s typically divided into time buckets like:

- 0–30 days

- 31–60 days

- 61–90 days

- 91–120 days

- 120+ days

This report helps you identify:

- Claims that need urgent follow-up (especially older ones).

- Workflow or billing issues causing delays.

- Whether your billing team (or company) is effectively working on outstanding accounts.

A growing balance in the 91–120 or 120+ buckets is a red flag that needs immediate attention.

What should I do if claim denials are increasing?

If your denial rates are creeping up, here’s what you should investigate:

- Coding Issues: Are certain CPT codes being rejected? You might need to review your coding practices.

- Eligibility Checks: Is your front desk verifying insurance eligibility before appointments? Missing this step can lead to rejections.

- Documentation Errors: Are claims being submitted with all required documentation?

Regular denial trend analysis (monthly or quarterly) will help you pinpoint and resolve these issues.

How do I track my top payers?

Your billing software should provide a breakdown of revenue by payer, showing:

- Total charges billed to each insurance company.

- Payments received from each payer.

- Denials or payment delays by payer.

Tracking your top payers helps you identify which insurance companies are contributing the most to your revenue—and which ones may require contract renegotiation.

How do CPT code reports help my practice?

A CPT code analysis shows:

- Which codes are billed most frequently.

- Which codes bring in the highest reimbursements.

- Denial rates for specific codes.

This data is invaluable for:

- Adjusting workflows to reduce coding errors.

- Understanding which services generate the most revenue.

- Negotiating higher reimbursements for your most-used CPT codes.

What can I learn from a denial trend report?

A denial trend report shows which claims are being rejected, why, and by which payers. Common denial reasons include:

- Coding errors.

- Missing documentation.

- Eligibility or authorization issues.

By analyzing these trends, you can:

- Train your staff to prevent common mistakes.

- Adjust workflows to address recurring problems.

- Focus on appealing denials with high revenue potential.

How can financial reports help with patient collections?

Financial reports track:

- How much your front desk is collecting at the time of service (co-pays, deductibles, etc.).

- Outstanding balances owed by patients.

- Whether payments are being properly posted to patient accounts.

By running a patient balance report for your daily schedule, your staff can focus on collecting payments at check-in, reducing the likelihood of overdue accounts.

What are the benefits of quarterly financial reports?

Quarterly reports provide a broader view of your practice’s performance, helping you:

- Spot revenue trends over a longer period.

- Compare provider productivity across three months.

- Identify seasonal patterns (e.g., dips in patient visits during holidays).

They complement your monthly reports and help you make more strategic, long-term decisions.

How do year-end financial reports help with budgeting?

Year-end reports provide a comprehensive view of your practice’s financial health. Use them to:

- Review revenue trends by provider, payer, and CPT code.

- Compare beginning and ending accounts receivable (AR).

- Identify inefficiencies in billing and collections.

- Set realistic budgets for payroll, supplies, and other expenses.

Additionally, they can highlight opportunities to renegotiate payer contracts or expand service offerings.

What if my billing software doesn’t provide detailed reports?

If your billing software lacks robust reporting tools, consider:

- Hiring a billing specialist to create custom reports.

- Investing in software upgrades or a third-party reporting tool.

- Outsourcing billing to a company that provides detailed financial reporting as part of its service.

Financial reports are critical for running a profitable practice—if your current tools aren’t cutting it, it’s worth exploring alternatives.

How can financial reports help a new practice?

For new practices, financial reports are essential for:

- Tracking cash flow and ensuring payments are collected.

- Identifying which services (CPT codes) generate the most revenue.

- Evaluating payer performance and reimbursement rates.

- Budgeting for overhead expenses and future growth.

In the first year, running these reports frequently (daily, weekly, and monthly) will help you establish strong financial foundations.

What metrics should I focus on in my financial reports?

Key metrics to monitor in financial reports for your medical practice include:

- Net Collection Rate: How much you’ve collected versus how much you’re allowed to collect.

- Denial Rate: The percentage of claims being rejected.

- A/R Days Outstanding: The average time it takes to collect payments.

- Revenue by Payer: Which insurance companies contribute the most to your revenue.

- Average Reimbursement by CPT Code: How much you’re getting paid for specific services.

Tracking these metrics consistently will give you a clear picture of your practice’s financial health.

What should I do if I’m overwhelmed by financial reports?

If you’re feeling overwhelmed, start small:

- Focus on daily and weekly reports to ensure payments are being collected and posted correctly.

- Gradually add monthly reports to track trends and address issues.

- If needed, hire a billing specialist or outsource reporting to free up your time.

The goal is to use financial reports as tools—not headaches—to grow your practice.

Final Thoughts on Financial Reports

Monthly, quarterly, and year-end financial reports for your medical practice aren’t just about tracking dollars—they’re about giving you the data you need to make better decisions. By staying on top of these reports, you can streamline your workflows, maximize revenue, and plan for a successful future.