Avoid Denials! Clean Claim Strategies for Faster Medical Billing Payments

Clean claims in medical billing are your secret weapon for getting paid faster and avoiding frustrating denials. If you’re tired of rejected claims, delayed payments, or endless corrections, it’s time to fix that. In this guide, I’ll break down exactly how to improve your clean claim rate, streamline your revenue cycle, and maximize your reimbursements.

Key Takeaways

- Clean claims are error-free submissions that get paid without denials or corrections.

- First-time pass rate (FPR) should be 95%+ to ensure smooth revenue cycles.

- Common claim denial reasons include eligibility issues, incorrect coding, and missing modifiers.

- Automating claim scrubbing can reduce errors and increase approval rates.

- Regular training for billing staff and front desk teams helps prevent avoidable mistakes.

What Are Clean Claims in Medical Billing?

Before we get into how to improve clean claim rates in medical billing, let’s make sure we’re clear on what a clean claim actually is.

A clean claim is a medical claim that:

- Has all required billing information (ICD codes, CPT codes, modifiers, etc.)

- Is submitted to insurance without errors, missing data, or incorrect information

- Doesn’t get rejected or denied by the payer

- Gets processed and paid quickly, with no back-and-forth corrections

Basically, a clean claim is a moneymaker. It goes through the system seamlessly, reducing the amount of work needed to correct errors, resubmit, or appeal denials.

If you’re constantly dealing with rejected or denied claims, it means you’re wasting time and money fixing them instead of focusing on new claims.

Now, let’s talk about why clean claims matter and how to get them right the first time.

Why Clean Claims Matter: The Real Cost of Rejected Claims

You might be thinking, “Okay, so my claims get denied sometimes. No big deal, I’ll just fix them and resubmit.”

Wrong.

Every denied or rejected claim costs you time, money, and resources. Think about all the hands that touch a claim before it finally gets paid:

- First, someone scrubs it before submission

- Then, another person submits it

- If it gets rejected, another staff member has to fix it

- Then someone reprocesses and resubmits the claim

- And then—finally—you (hopefully) get paid

Every extra step eats into the claim’s value. The more work required, the lower your actual reimbursement.

And let’s not forget contractual adjustments. Even if your charge is, say, $500 for a service, you’re probably not getting the full amount due to CO-45 contractual write-offs.

Now, imagine that claim also gets denied. The more time and effort your team spends correcting and resubmitting it, the less it’s worth to your practice.

👉 Moral of the story? Clean claims = Faster payments + Less work + More revenue.

A Guide for Medical Providers about CO 45 Denial Code

How to Improve Clean Claim Rates in Medical Billing

Now, let’s get to the good stuff—how to improve clean claim rates in medical billing so your claims sail through the system flawlessly.

1. It All Starts at the Front Desk

Believe it or not, clean claims begin before the patient even sees a provider.

Your scheduling and front desk teams play a crucial role in ensuring claims go out clean. They need to:

- Verify insurance eligibility before the visit

- Check that the provider is in-network with the patient’s insurance

- Confirm the correct place of service (POS) code is assigned (e.g., 11 for an office visit, 02 for telehealth)

- Ensure benefits cover the services rendered

Even a simple mistake at the front desk—like entering the wrong insurance details—can result in a rejected claim. That’s why staff training is key.

2. Get the Coding Right: No Shortcuts Allowed

If you’re not meticulous with your coding, your claims will come back denied. Simple as that.

CPT & ICD Codes Must Match: The diagnosis (ICD) codes need to be directly linked to the procedure (CPT) codes for medical necessity. If they don’t match correctly, expect a denial.

Use the Right Modifiers: Ever had a claim denied because of “bundling issues”? That’s usually because someone forgot to add modifier 25 (for separate E/M services) or modifier 59 (for distinct services).

Double-Check Authorization & Referrals: Certain services require pre-authorization. If you forget, your claim will be denied—no questions asked.

Pro tip: Have a dedicated coding specialist or use automated scrubbing tools to catch errors before submission.

3. Review & Scrub Every Claim Before Submission

Even the best billers make mistakes. That’s why claim scrubbing is a must.

What is claim scrubbing? It’s a process where your billing system (or a human reviewer) checks claims for errors before submission.

- Are all required fields completed?

- Do diagnosis codes match the procedures performed?

- Are modifiers used correctly?

- Is the provider credentialed with the payer?

- Are there any missing authorizations?

A simple review before submission can increase your first-time pass rate to 95% or higher.

Advanced Strategies to Improve Clean Claim Rates in Medical Billing

Now that we’ve covered the basics, it’s time to level up your claim game. If you want to hit that golden 95%+ first-time pass rate, you need a proactive strategy that prevents errors before they happen.

In this section, we’re going deeper into how to improve clean claim rates in medical billing with advanced techniques. Let’s get started.

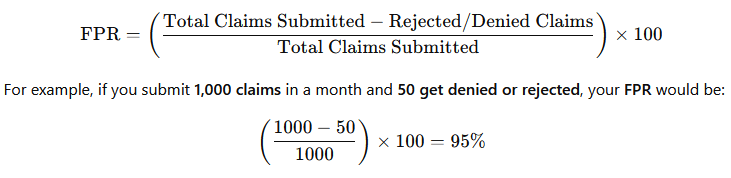

4. Track & Improve Your First-Time Pass Rate

If you don’t track your first-time pass rate (FPR), how do you even know if your claims are getting through?

Your FPR is the percentage of claims that get processed successfully the first time without rejections or denials.

Here’s how to calculate it:

First-Time Pass Rate Formula

💡 Goal: Keep your FPR at 95% or higher. Anything lower, and you’ve got a problem.

Pro Tip: Run a monthly Claim Rejection & Denial Report to track trends and spot recurring issues.

5. Identify & Fix Your Top Denial Reasons

Not all denials are created equal. Some are avoidable and happen over and over again. If you’re serious about how to improve clean claim rates in medical billing, you need to identify the root causes.

Here are the most common denial reasons and how to fix them:

| Denial Reason | Why It Happens | How to Fix It |

|---|---|---|

| Eligibility Issues | Patient’s insurance coverage was inactive or incorrect | Verify eligibility before the visit |

| Incorrect CPT/ICD Code Pairing | Diagnosis code doesn’t justify the procedure performed | Ensure proper medical necessity documentation |

| Missing/Incorrect Modifiers | Modifier needed but not included | Use modifier 25, 59, or appropriate codes |

| Lack of Prior Authorization | Service required pre-approval from payer | Always check payer authorization rules |

| Timely Filing Issues | Claim submitted past payer’s deadline | Submit claims ASAP and track aging reports |

💡 Pro Tip: Create a Denial Management Team that reviews denied claims, finds patterns, and trains staff on how to avoid them in the future.

6. Automate, Automate, Automate

Still manually scrubbing claims? Stop wasting time.

Claim automation software can catch errors before submission, flag missing data, and even suggest correct CPT/ICD pairings.

Some top tools include:

- Availity – Real-time eligibility verification

- Waystar – AI-powered claim scrubbing & tracking

- Change Healthcare – Denial management & revenue cycle tools

Pro Tip: Set up automated claim scrubbing rules so errors get flagged before they reach the payer.

7. Train Your Staff Like Revenue Cycle Ninjas

Even the best software won’t fix a poorly trained team. Your billing, coding, and front desk staff need to be trained regularly on:

- Insurance verification & eligibility checks

- Proper CPT & ICD-10 coding

- Modifier usage & bundling rules

- Timely filing deadlines

- Authorization & referral requirements

💡 Pro Tip: Host monthly training sessions to go over common claim mistakes and payer updates.

8. Conduct Regular Internal Audits

You might think you’re doing everything right—until an audit proves you wrong.

Regular internal claim audits help you spot problems before payers do. Here’s what to check:

- Randomly pull 10-20 claims per month

- Verify all data is complete and accurate

- Ensure correct CPT & ICD codes are used

- Check if modifiers were applied correctly

- Look for trends in common mistakes

💡 Pro Tip: If you want flawless audits, bring in external coders once a year for an objective review.

9. Work Smarter With Payer Portals

Insurance payers want you to submit clean claims (it saves them money, too). That’s why payer portals exist.

Most major payers (Aetna, Cigna, BCBS, etc.) offer real-time claim status tools where you can:

- Check eligibility before visits

- See real-time claim rejections (and fix them fast)

- View denial reasons & appeal online

💡 Pro Tip: Set up weekly payer portal reviews to catch and fix errors before they become a bigger problem.

10. Stop Sending Dirty Claims & Fix Issues Upstream

The best way to improve clean claim rates? Stop sending bad claims in the first place.

If you constantly have errors, denials, and rejections, you need to fix the problem at the source. That means:

- Training front desk staff on eligibility & benefit verification

- Ensuring providers document all necessary services & diagnoses

- Having coders review claims before submission

- Using automation tools to catch errors early

💡 Pro Tip: Instead of fixing dirty claims, invest in fixing your processes so errors never happen in the first place.

Mastering Medical Billing: Reduce Denials & Improve Clean Claim Rates

Even with the best processes, some denials are inevitable. The key is knowing how to prevent them, fix them fast, and avoid making the same mistakes again.

Why Denied Claims Are a Bigger Problem Than You Think

Every denied claim is a ticking time bomb.

The more denials pile up, the longer your accounts receivable (AR) age, and the harder it is to collect payment.

Here’s why you can’t afford to ignore denied claims:

- Denied claims take 2x longer to process than clean claims

- 65% of denied claims are never resubmitted, which means lost revenue

- A 5% increase in denials can result in millions in lost revenue for larger practices

💡 The solution? Build a strong denial prevention & management system.

Top 5 Denial Categories & How to Fix Them

To reduce denials, you need to understand why they happen in the first place.

Here are the five most common denial categories and how to prevent them:

| Denial Category | Common Causes | How to Fix It |

|---|---|---|

| Eligibility & Coverage Issues | Inactive insurance, wrong payer, policy doesn’t cover service | Verify eligibility before the visit |

| Missing or Invalid Information | Incorrect CPT/ICD codes, missing NPI, demographic errors | Use claim scrubbing software |

| Authorization/Referral Missing | Required pre-authorization not obtained | Check payer guidelines before treatment |

| Timely Filing Exceeded | Claim submitted past deadline | Track timely filing limits & submit ASAP |

| Bundling & Modifier Errors | Wrong modifier, services bundled incorrectly | Train staff on proper modifier usage |

💡 Pro Tip: 80% of denials come from just 20% of claim errors. Fix those recurring issues first to see the biggest improvement.

The 3-Step Denial Management System

If you want to reduce denials and improve clean claim rates, follow this three-step process for managing claim denials efficiently:

Step 1: Identify the Root Cause

Pull a denial report from your billing system

Categorize denials by reason, payer, and department

Look for patterns in common errors

Example:

If you see 50 denials last month due to missing prior authorizations, that’s not just a billing issue—it’s a process failure that needs fixing upstream.

Step 2: Correct & Resubmit Quickly

Every denied claim is a race against time.

⏳ Most payers give you 90-180 days to appeal denials—miss the window, and you lose the revenue forever.

Fix simple errors immediately (e.g., missing modifiers, coding issues)

Check payer guidelines for resubmission rules

Appeal when necessary—some claims just need better documentation

💡 Pro Tip: Use denial tracking software to monitor progress and prevent claims from slipping through the cracks.

Step 3: Prevent Future Denials

Your goal should always be to stop denials from happening in the first place.

Train your team regularly on top denial causes

Use automation for eligibility checks & claim scrubbing

Hold monthly meetings to review denial trends & process improvements

Example:

If you’re seeing a rise in eligibility-related denials, maybe your front desk team needs better insurance verification training.

💡 Pro Tip: If a specific payer is causing excessive denials, set up direct communication with their provider rep to resolve issues faster.

Proven Strategies to Improve Your First-Time Pass Rate (FPR)

If you want to maximize revenue, your first-time pass rate (FPR) should be above 95%.

Here’s how to improve clean claim rates in medical billing and get claims approved the first time:

1. Pre-Visit Eligibility Verification

Verify insurance coverage & benefits before the appointment

Check payer policies for pre-authorization requirements

Ensure correct patient demographics & policy numbers

💡 Pro Tip: Automate eligibility verification so your staff doesn’t have to do it manually.

2. Smart Coding & Modifier Usage

Make sure CPT codes match the ICD-10 diagnosis

Use modifier 25 for separately identifiable E/M services

Apply modifier 59 when unbundling is necessary

💡 Pro Tip: AI-driven coding tools can suggest the correct CPT-ICD combinations to prevent coding denials.

3. Real-Time Claim Scrubbing

Don’t submit claims blindly! Use claim scrubbing tools to:

- Check for missing fields before submission

- Ensure diagnosis & procedure codes align

- Flag modifier errors & payer-specific rules

💡 Pro Tip: Many clearinghouses offer automated scrubbing tools that flag errors instantly before submission.

4. Timely Filing & Tracking

Even perfect claims can get denied if they’re submitted too late.

Track each payer’s filing deadlines (some are as short as 30 days!)

Submit claims as soon as possible after the encounter

Use automated alerts to flag approaching deadlines

💡 Pro Tip: Set up real-time dashboards to monitor claim status & prevent timely filing denials.

Frequently Asked Questions (FAQ)

What is a clean claim in medical billing?

A clean claim is a medical claim that contains all necessary information, is free of errors, and gets processed and paid without rejections or denials. Ensuring clean claims reduces back-and-forth corrections, speeds up reimbursement, and keeps your revenue cycle running smoothly.

Why do claims get denied?

Claims are denied for various reasons, including incorrect coding, missing modifiers, eligibility issues, or lack of prior authorization. By proactively addressing these common errors and using automation tools, practices can prevent most denials before claims are even submitted.

How can I improve my clean claim rate?

To improve your clean claim rate, focus on accurate patient information, correct coding, timely submission, and real-time claim scrubbing. Training staff on eligibility verification and using automated billing tools can also help minimize errors and increase first-time claim acceptance.

What is a first-time pass rate (FPR)?

The first-time pass rate (FPR) is the percentage of claims that get approved and paid on the first submission, without requiring corrections or resubmission. A high FPR (95% or higher) ensures faster payments and fewer denials, improving overall revenue cycle efficiency.

How can automation help reduce claim denials?

Automation tools can verify patient eligibility, check for coding errors, flag missing information, and scrub claims before submission. These technologies catch issues early, preventing rejections and significantly reducing administrative workload for billing teams.

What are the most common reasons for claim denials?

Common denial reasons include eligibility issues, incorrect CPT/ICD code matching, missing or incorrect modifiers, lack of prior authorization, and untimely filing. Regular tracking and analysis of denial patterns can help identify and resolve recurring issues.

How do payer portals help with claim management?

Payer portals provide real-time claim tracking, eligibility verification, and instant access to denial reasons. Using these tools helps billing teams quickly address errors, submit corrections, and prevent unnecessary claim rejections.

What is claim scrubbing, and why is it important?

Claim scrubbing is the process of reviewing claims for errors before submission. It ensures that all required information is accurate and complete, reducing the likelihood of rejections. Automated claim scrubbing tools help practices maintain a high first-time pass rate.

How can front desk staff help reduce claim denials?

Front desk staff play a crucial role by verifying insurance eligibility, ensuring correct patient information, and checking coverage details before the appointment. Training them to catch issues early can prevent costly claim denials down the line.

What steps should be taken after a claim denial?

After a denial, identify the reason, correct any errors, and resubmit the claim promptly. Many payers allow appeals within a set timeframe, so tracking denials and following up quickly can increase the chances of reimbursement.

Why is timely filing important in medical billing?

Most payers have strict deadlines for claim submission, often ranging from 30 to 180 days. Missing these deadlines results in automatic denials with no option for appeal, leading to lost revenue. Tracking payer-specific filing limits is essential for avoiding timely filing denials.

How often should a practice audit its claims?

Regular internal audits, ideally monthly or quarterly, help identify common billing errors and areas for improvement. Practices should review a sample of claims to ensure compliance with coding guidelines and payer requirements, reducing the risk of denials.

Can outsourcing medical billing improve clean claim rates?

Yes, outsourcing to experienced billing professionals or revenue cycle management companies can improve clean claim rates. These providers use advanced software, stay updated on payer guidelines, and have dedicated teams to handle claim submission and denials efficiently.

What role do modifiers play in clean claims?

Modifiers provide additional details about a service or procedure. Incorrect or missing modifiers can lead to claim denials. Common examples include Modifier 25 (separate evaluation and management) and Modifier 59 (distinct procedural service), both of which help ensure proper reimbursement.

How does provider credentialing affect claim approvals?

If a provider isn’t credentialed with a payer, claims for their services will be denied. Keeping credentialing records updated and verifying participation with each payer ensures smooth claim processing and prevents unnecessary rejections.

What are the financial benefits of clean claims?

Clean claims lead to faster reimbursements, reduced administrative workload, fewer resubmissions, and increased revenue. They also improve cash flow by minimizing delays and denials, allowing practices to focus on patient care rather than claim disputes.

How can I track and improve my billing performance?

Running regular reports on claim denials, first-time pass rates, and aging accounts receivable can help practices monitor billing performance. Identifying trends and implementing targeted improvements can lead to more efficient revenue cycle management.

Mastering Clean Claims: Final Takeaways for Medical Billing Success

We’ve covered everything you need to know about how to improve clean claim rates in medical billing—from reducing denials to optimizing your revenue cycle. If you’ve made it this far, congratulations! You’re well on your way to getting paid faster, minimizing claim errors, and boosting your bottom line.

Let’s do a quick recap of the most important lessons:

- ✅ Clean claims = Faster payments, fewer headaches, and more revenue

- ✅ Track your first-time pass rate (FPR) and aim for 95%+ approval on first submission

- ✅ Most denials are preventable—fix eligibility issues, coding errors, modifier mistakes, and missing authorizations before claims go out

- ✅ Claim scrubbing software is a game-changer—use it to catch errors before submission

- ✅ Timely filing matters—submit claims ASAP and track payer deadlines to avoid unnecessary rejections

- ✅ Ongoing staff training is key—keep your billing, front desk, and coding teams updated on best practices

Final Thought: Be Proactive, Not Reactive

The biggest mistake in medical billing? Waiting for denials to happen before fixing issues.

If you’re constantly reworking claims, you’re losing money. Instead, fix the root causes upstream:

- Better eligibility checks = Fewer coverage-related denials

- Stronger coding accuracy = Fewer CPT/ICD mismatches

- Automated claim scrubbing = Fewer rejected claims

- Faster resubmissions = Higher recovery rates on denials

Medical billing isn’t just about submitting claims—it’s about mastering the process to maximize revenue. The more efficient and error-free your workflow, the faster you get paid.

Now It’s Your Turn!

What’s the biggest challenge you face with clean claims and denials? Drop a comment below—I’d love to hear your thoughts and help you troubleshoot!